A mortgage loan is a foundational financial product in the world of real estate, allowing individuals and families to own homes without paying the full price upfront. With the average home price often being beyond reach for most people, mortgages break down this large financial commitment into manageable monthly payments.

But behind this seemingly straightforward concept lies a complex interplay of financial agreements, legal protections, interest computations, government regulations, and personal finance strategies.

This article will explore the ins and outs of mortgage loans from basic concepts to advanced strategies, helping you become an informed homebuyer or homeowner.

Key Takeaways

Managing your mortgage responsibly is crucial for financial health.

Mortgages use the property as collateral.

Monthly payments include principal, interest, taxes, and insurance.

Fixed and adjustable rates serve different financial strategies.

Your credit profile and income heavily influence mortgage approval.

Refinancing can save money but comes with costs.

Government programs can ease access to homeownership.

Understanding Mortgages — The Basics

What Is a Mortgage?

At its core, a mortgage is a loan secured by real estate. When you borrow money from a bank or lender to buy a home, the lender places a lien on the property. This lien ensures that if you do not repay your loan according to the terms, the lender can foreclose on the property and sell it to recover the money lent.

Why secured? Because the property acts as collateral. This security reduces lender risk, allowing borrowers to access larger amounts of money and often at lower interest rates compared to unsecured loans like credit cards or personal loans.

The Anatomy of a Mortgage Loan

Principal, Interest, Taxes, and Insurance (PITI)

Your monthly mortgage payment is generally composed of four parts, commonly referred to by the acronym PITI:

- Principal: The original loan amount or balance remaining. This portion reduces your loan over time.

- Interest: The fee the lender charges for borrowing money, usually expressed as an annual percentage rate (APR).

- Taxes: Property taxes assessed by your local government, often collected through an escrow account by your lender.

- Insurance: Includes homeowners insurance (mandatory) and private mortgage insurance (PMI) if your down payment is less than 20%.

Mortgage Types and How They Differ

Fixed-Rate Mortgages

- Definition: Interest rate remains constant over the life of the loan.

- Best For: Buyers who want predictable payments and plan to stay long-term.

- Example: A 30-year fixed loan offers stable monthly payments but may have a higher initial rate than an ARM.

Adjustable-Rate Mortgages (ARMs)

- Definition: Interest rate is fixed for an initial period (e.g., 5 years), then adjusts annually based on an index rate.

- Best For: Buyers expecting to move or refinance before the adjustment period ends.

- Risk: Potentially higher payments after the fixed period.

Government-Backed Loans

- FHA Loans: Require lower down payments (3.5%), ideal for first-time buyers or those with imperfect credit.

- VA Loans: Benefit military veterans with no down payment and no PMI.

- USDA Loans: For rural buyers with low-to-moderate income, offering zero down payment.

Interest-Only Loans

- You pay only interest for an initial period (e.g., 10 years), then principal plus interest afterward.

- Can be risky if the borrower is unprepared for payment increases.

Jumbo Loans

- Loans that exceed conforming loan limits, often used for luxury homes.

- Require excellent credit and larger down payments.

How Interest Is Calculated

Simple vs. Compound Interest

Mortgages use simple interest, calculated daily based on your outstanding principal balance. Each monthly payment includes a portion of principal and interest.

Amortization Schedules

Mortgages are amortized over their term. Early in the loan, payments consist mostly of interest; later payments increasingly reduce principal.

| Payment Number | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|

| 1 | $500 | $1,500 | $299,500 |

| 100 | $1,200 | $800 | $150,000 |

| 360 | $1,790 | $10 | $0 |

The Mortgage Application Process — A Detailed Walkthrough

- Preparation: Collect financial documents like tax returns, W-2s, pay stubs, bank statements.

- Pre-Qualification: Initial step to estimate loan eligibility.

- Pre-Approval: Formal approval with documentation; stronger for home offers.

- Loan Estimate: Lenders must provide a detailed estimate of loan costs within 3 days of application.

- Processing: Verification of employment, credit, assets.

- Underwriting: Risk assessment and final decision.

- Approval & Closing Disclosure: Final approval with detailed closing costs.

- Closing: Sign paperwork, pay closing costs, take ownership.

Refinancing Mortgages — When and How?

Refinancing replaces your current mortgage with a new one, often to:

- Reduce interest rates and monthly payments.

- Shorten loan terms.

- Switch loan types (ARM to fixed, vice versa).

- Cash out home equity.

Considerations:

- Closing costs for refinancing (2-5% of loan amount).

- Break-even point calculation: How long it takes to recover refinancing costs.

- Impact on credit score due to new inquiries.

Mortgage Insurance — What You Need to Know

Private Mortgage Insurance (PMI)

- Required if down payment is less than 20%.

- Protects lenders if borrower defaults.

- Typically 0.5%-1% of loan annually.

- Can be canceled once equity reaches 20%-22%.

FHA Mortgage Insurance Premium (MIP)

- FHA loans require upfront and annual MIP, regardless of down payment size.

The Impact of Mortgages on Credit Scores

- Applying causes a hard inquiry, potentially lowering scores temporarily.

- Timely payments improve credit history.

- Late or missed payments damage credit and risk foreclosure.

- Paying off or refinancing can alter credit age and score.

Government Assistance Programs and How They Help

- FHA Loans: Lower credit thresholds.

- VA Loans: No down payment or PMI.

- USDA Loans: Zero down for rural homes.

- State and local programs: Often provide grants or low-interest loans for first-time buyers.

Tax Benefits and Mortgage Loans

- Mortgage Interest Deduction: Can save money on taxes by deducting interest paid on mortgage loans up to $750,000.

- Property Tax Deduction: Deduct property taxes paid.

- Limitations: Subject to IRS rules and itemizing deductions.

Common Mortgage Mistakes to Avoid

- Overextending financially.

- Not shopping multiple lenders.

- Ignoring closing costs.

- Missing payments or ignoring escrow.

- Failing to understand loan terms.

- Not locking in rates timely.

Real-World Examples

Example 1: Fixed-Rate Mortgage

Jane buys a $350,000 home with 20% down ($70,000). She takes out a 30-year fixed mortgage for $280,000 at 6%. Monthly P&I payment is about $1,678.

Example 2: ARM Scenario

Mike chooses a 5/1 ARM at 4% initial rate on a $300,000 loan. Payments are low for five years, then adjust annually. If rates rise, payments increase, requiring careful planning.

How to Improve Your Mortgage Application

- Boost your credit score by paying bills on time.

- Reduce outstanding debts.

- Save for a larger down payment.

- Avoid opening new credit accounts before applying.

- Gather all financial documents.

- Maintain steady employment history.

Future Trends in Mortgages

- Digital mortgage applications speeding approvals.

- Increased use of AI in underwriting.

- More flexible credit scoring models.

- Rise of green mortgages for energy-efficient homes.

The Mortgage Amortization Process Explained in Depth

Amortization is the process of paying off your mortgage loan over time through scheduled, regular payments. Each payment partly covers interest and partly reduces the principal.

How Amortization Works

- Early Years: Majority of payment covers interest.

- Later Years: Increasing portion applies to principal.

Here’s why:

Interest is charged on the outstanding balance, which is highest at the start. As you pay down principal, interest charges decrease, and more payment applies to principal reduction.

Amortization Schedule Example (First 5 Payments on $300,000, 30-year, 6% fixed loan)

| Payment # | Payment Amount | Principal Paid | Interest Paid | Remaining Balance |

|---|---|---|---|---|

| 1 | $1,798.65 | $298.65 | $1,500.00 | $299,701.35 |

| 2 | $1,798.65 | $300.15 | $1,498.50 | $299,401.20 |

| 3 | $1,798.65 | $301.66 | $1,497.00 | $299,099.54 |

| 4 | $1,798.65 | $303.17 | $1,495.49 | $298,796.37 |

| 5 | $1,798.65 | $304.69 | $1,493.97 | $298,491.68 |

By payment 360, almost the entire payment goes toward principal.

Economic Factors That Influence Mortgage Rates

Mortgage rates are affected by many macroeconomic variables:

- Federal Reserve Policies: While the Fed doesn’t set mortgage rates, their policies influence bond yields, which mortgage rates track.

- Inflation: High inflation tends to push rates up.

- Employment Data: Strong job markets can lead to higher rates.

- Housing Market Trends: Supply and demand impact lender risk appetite.

- Global Economic Stability: Political and economic uncertainties can cause rates to fluctuate.

How This Affects Borrowers

Rising rates increase borrowing costs; falling rates can incentivize refinancing.

The Underwriting Process — What Lenders Really Look At

Underwriting is the lender’s detailed risk assessment, which includes:

- Credit History: Payment history, credit utilization.

- Income Verification: Pay stubs, tax returns, employment letters.

- Assets: Savings, investments, checking accounts.

- Debt-to-Income Ratio (DTI): Front-end ratio (housing expenses vs income), back-end ratio (all debts vs income).

- Property Appraisal: Confirms market value supports the loan amount.

- Title Search: Ensures clear ownership and no liens.

Lenders use automated systems combined with manual review to approve or reject.

Psychological and Social Impact of Mortgage Debt

Owning a mortgage impacts homeowners beyond finance:

- Emotional Security: Homeownership often increases feelings of stability.

- Stress: Financial obligations can create anxiety, especially if payments become challenging.

- Social Mobility: Owning property can improve credit and net worth.

- Intergenerational Wealth: Homes often transfer equity across generations.

Understanding this human element can help you approach your mortgage with a balanced mindset.

Managing Your Mortgage Debt Strategically

Accelerated Payments

Making extra payments or paying biweekly can significantly reduce interest paid and shorten loan term.

Refinancing Strategies

- Refinancing to a shorter term can increase payments but reduce total interest.

- Cash-out refinancing can provide funds but increases debt.

Budgeting for Variable Expenses

Property taxes and insurance can change annually; budgeting cushions help avoid surprises.

Special Mortgage Terms and Features

Escrow Accounts

Why lenders use escrow to ensure taxes and insurance are paid timely.

Prepayment Penalties

Some loans charge fees for paying off early; rare today but important to check.

Assumable Mortgages

Allows new buyers to take over existing loan terms, valuable if rates rise.

Mortgage Points

- Discount Points: Lower interest rate for upfront fee.

- Origination Points: Fees to compensate lender for processing.

How Technology Is Changing Mortgages

- Online mortgage applications speed approvals.

- AI underwriting improves risk analysis.

- Mobile apps track payments, escrow, and amortization.

- Blockchain explored for title and loan documentation security.

Common Pitfalls in Mortgage Loans and How to Avoid Them

- Taking on more debt than affordable.

- Failing to read loan documents carefully.

- Ignoring potential future rate increases on ARMs.

- Skipping home inspections.

- Not understanding total cost including closing fees.

- Missing deadlines during approval process.

Real-Life Case Study: John and Emily’s Mortgage Journey

- Profile: John and Emily, first-time buyers.

- Home Price: $320,000.

- Loan Type: FHA loan with 3.5% down.

- Credit Scores: John 680, Emily 710.

- Process: Pre-approved, found home, got appraisal, closed in 40 days.

- Monthly PITI: $1,850.

- Lessons: Importance of pre-approval and budgeting for closing costs.

Legal Framework of Mortgage Loans — Rights and Obligations

A mortgage loan is not just a financial product but a legal contract binding the borrower and lender.

Key Legal Elements:

- Promissory Note: Your promise to repay the loan.

- Mortgage or Deed of Trust: Security instrument giving lender lien rights on the property.

- Default and Foreclosure Clauses: Conditions under which the lender can seize the property.

- Right of Redemption: Borrower’s chance to reclaim property after foreclosure within a certain period (varies by state).

- Escrow Agreements: Management of tax and insurance payments.

- Disclosure Requirements: Lenders must provide clear terms under laws like the Truth in Lending Act (TILA).

Understanding your rights and obligations helps avoid surprises and protects your interests.

The History and Evolution of Mortgage Loans

Mortgages have existed for centuries but have evolved dramatically:

- Ancient Times: Early forms involved land as collateral with harsh penalties.

- 19th Century: The rise of formal banking and standardized loans.

- Post-WWII: The creation of agencies like FHA and VA to expand homeownership.

- Late 20th Century: Introduction of adjustable rates, securitization of loans.

- 21st Century: The 2008 financial crisis reshaped lending practices, emphasizing regulation and consumer protection.

This history reflects the balance between economic growth, consumer protection, and financial innovation.

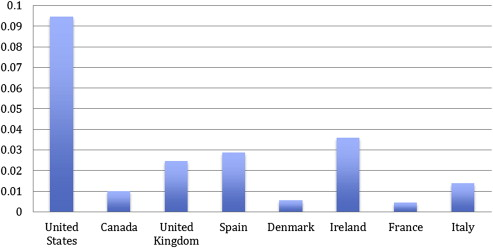

International Mortgage Practices — How Do Other Countries Compare?

Mortgage systems vary globally:

- UK: Interest-only mortgages are more common; fixed terms typically 2-5 years.

- Germany: Often long fixed terms (up to 30 years), less reliance on adjustable rates.

- Australia: Variable rate loans predominate, with flexible repayment options.

- Canada: Typically shorter amortization periods (25 years max) with strict underwriting.

Comparing systems highlights cultural and regulatory differences impacting borrowers’ experiences.

How to Optimize Your Mortgage — Advanced Strategies

1. Mortgage Acceleration

- Making biweekly payments cuts years off your loan.

- Lump sum payments reduce principal and future interest.

2. Rate Shopping and Negotiation

- Compare multiple lenders’ rates and fees.

- Negotiate closing costs, points, and terms.

3. Refinancing Timing

- Refinancing when rates drop by at least 0.75%-1% is generally beneficial.

- Consider break-even point and closing costs carefully.

4. Down Payment Strategies

- Larger down payments reduce PMI and loan amount.

- Gift funds and grants can boost down payment.

5. Choosing the Right Loan Term

- Shorter terms save interest but increase monthly payments.

- Long terms ease cash flow but cost more interest overall.

Risks and How to Protect Yourself

Risks:

- Default and Foreclosure: Failure to pay leads to losing your home.

- Interest Rate Risk: Adjustable loans can increase payments unexpectedly.

- Market Risk: Home values can decline, creating negative equity.

- Job Loss or Income Changes: Affect ability to pay mortgage.

- Hidden Fees and Costs: Unexpected expenses erode budget.

Protection:

- Maintain an emergency fund covering 3-6 months of payments.

- Choose loan products matching your financial situation.

- Obtain homeowners insurance and consider mortgage protection insurance.

- Understand all loan terms before signing.

- Work with trusted real estate and mortgage professionals.

Mortgage Jargon Demystified

| Term | Simple Explanation |

|---|---|

| Amortization | Paying off loan over time through set payments. |

| Escrow | Account to hold taxes and insurance payments. |

| Loan-to-Value (LTV) | Loan amount divided by home value, shows risk level. |

| Private Mortgage Insurance (PMI) | Insurance protecting lender if you default. |

| Points | Fees paid upfront to reduce interest rate or cover lender costs. |

| Pre-Approval | Lender’s conditional agreement on loan amount based on documents. |

| Underwriting | Lender’s detailed evaluation of risk and borrower’s ability to repay. |

| Closing Costs | Fees and expenses due at loan closing besides down payment. |

Practical Advice for First-Time Buyers

- Get Pre-Approved First: Understand your budget and strengthen your offer.

- Budget for More Than Price: Include taxes, insurance, maintenance.

- Hire a Good Real Estate Agent: Experienced agents navigate complexities.

- Get a Home Inspection: Avoid costly surprises.

- Understand Your Loan Documents: Ask questions before signing.

- Plan Long-Term: Consider how long you’ll stay and possible future financial changes.

Mortgage Management for Seasoned Homeowners

- Review your mortgage annually to explore refinancing.

- Use home equity responsibly; consider home equity lines of credit (HELOCs).

- Stay current on insurance and taxes to avoid escrow shortages.

- Use extra income or bonuses to pay down principal.

- Keep detailed records of payments and loan documents.

Also Read:- What Will a Payday Loan Really Cost You?

Conclusion

Mortgages are vital financial instruments that enable homeownership and wealth building. They come with complexities but understanding the mechanics—loan types, interest, payments, risks, and benefits—gives you power to make informed decisions. Careful planning, education, and prudent financial management ensure your mortgage supports your homeownership goals sustainably.

FAQ

1. Can I get a mortgage if I’m self-employed?

Yes, but documentation requirements are stricter (tax returns, profit/loss statements).

2. What happens during foreclosure?

The lender seizes and sells your property to recover loan balance.

3. How do mortgage points work?

Paying points upfront lowers your interest rate; beneficial if you plan to stay long-term.

4. What is a balloon mortgage?

A loan with small payments initially but a large lump sum due at the end of term.

5. How can I pay off my mortgage early?

Make extra payments on principal, refinance to shorter terms, or make biweekly payments.

6. Are there penalties for paying off a mortgage early?

Some loans have prepayment penalties—always check the loan terms.

7. What is a loan estimate and closing disclosure?

Documents lenders provide to outline loan terms, fees, and closing costs.

8. Can I transfer my mortgage if I sell my home?

Typically no, but some loans have assumable clauses.