Personal loans have become a go-to financial instrument for millions worldwide who seek fast, unsecured credit. Unlike mortgages or car loans, personal loans typically do not require collateral, which increases accessibility but usually comes with a higher interest rate.

They serve a broad spectrum of needs:

- Covering emergency expenses (medical bills, urgent repairs)

- Financing weddings or travel

- Consolidating existing debt into a single manageable loan

- Funding education or professional courses

- Small home renovations or buying gadgets

Today, the personal loan market is highly competitive, with banks, NBFCs, fintech companies, and peer-to-peer lenders all vying to offer the most attractive rates and quickest approvals. With so many choices, finding the best personal loan rates is crucial to save money and manage repayment comfortably.

Key Takeaways

- Interest rates on personal loans today range from ~9.99% to 15%, with the best rates for borrowers with excellent credit.

- Credit score is the most critical factor affecting your loan interest rate.

- Shorter tenures reduce overall interest paid but increase EMIs.

- Public sector banks tend to have slightly higher rates but more security; private banks and NBFCs offer faster approval and sometimes lower rates.

- Always consider total loan cost, including processing fees and other charges, not just interest rates.

- Use online tools for comparison and look for pre-approved offers.

- Timely repayment keeps your credit healthy and opens doors for better loans in the future.

Understanding Personal Loan Interest Rates — The Basics

What Exactly Is a Personal Loan Interest Rate?

A personal loan interest rate is the percentage charged on the principal amount borrowed, expressed annually (per annum or p.a.). This rate directly influences the Equated Monthly Installments (EMIs) and the total amount repaid.

Example: On ₹5,00,000 loan at 12% p.a. interest over 5 years, monthly EMI is approximately ₹11,122.

Fixed vs. Floating Rates

- Fixed Rate: The interest remains constant throughout the tenure. EMIs stay the same, making budgeting easier.

- Floating Rate: Rates vary with the lender’s benchmark or market conditions. EMIs can fluctuate, increasing uncertainty but sometimes lowering costs when rates fall.

Most personal loans come with fixed rates for predictability.

Annual Percentage Rate (APR)

APR includes interest and other fees (processing fees, insurance). Comparing APRs is better than nominal interest rates alone to evaluate the real cost.

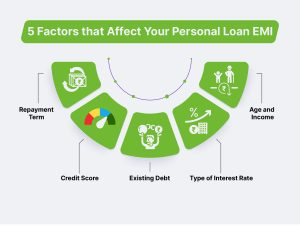

Factors Determining Personal Loan Interest Rates

1. Credit Score

Arguably the most important factor, your credit score (range 300-900) reflects your repayment history. Higher scores qualify you for the best rates.

- 750+ = Excellent: Lowest rates (~9.99% – 11%)

- 700-749 = Good: Moderate rates (~11% – 13%)

- 650-699 = Fair: Higher rates (~13% – 15%)

- Below 650 = Poor: Loans may be denied or come with very high rates (>15%)

2. Income and Employment Stability

Salaried individuals with a steady job, regular paycheck, and stable employment history generally get better rates than self-employed or contract workers.

3. Loan Amount and Tenure

- Larger loans might attract marginally lower rates but increase EMI burden.

- Longer tenure lowers EMIs but increases total interest outgo.

4. Debt-to-Income Ratio (DTI)

Lenders analyze your existing debt obligations against income to ensure you can repay comfortably. High DTI means riskier borrower and higher interest.

5. Relationship With the Bank

Existing customers with a strong relationship history (multiple accounts, previous loans) may get preferential rates.

6. Macroeconomic Factors

Reserve Bank of India’s repo rate, inflation, and economic conditions affect lending rates across banks.

What Are the Best Personal Loan Rates Available Today?

As of May 2025, here is a detailed rundown of leading lenders and their current rate offerings:

| Lender | Interest Rate p.a. (Starting) | Loan Amount Range | Tenure | Processing Time | Special Notes |

|---|---|---|---|---|---|

| IDFC FIRST Bank | 9.99% | ₹50,000 – ₹40 lakhs | 12 – 60 months | 1-2 days | Minimal docs, instant approval for salaried |

| HDFC Bank | 10.50% | ₹50,000 – ₹40 lakhs | 12 – 60 months | 2-3 days | EMI holiday available, digital onboarding |

| Axis Bank | 10.40% | ₹50,000 – ₹30 lakhs | 12 – 60 months | 1-2 days | Pre-approved offers for existing customers |

| ICICI Bank | 10.85% | ₹50,000 – ₹20 lakhs | 12 – 60 months | 1-3 days | Flexible tenure, multiple schemes |

| State Bank of India | 10.30% | ₹50,000 – ₹20 lakhs | 12 – 60 months | 3-5 days | Govt. backed, best for govt employees |

| Kotak Mahindra Bank | 10.99% | ₹50,000 – ₹25 lakhs | 12 – 60 months | 1-2 days | Flexible EMI options |

| Bajaj Finserv | 11.00% | ₹25,000 – ₹20 lakhs | 12 – 60 months | Instant online | Digital process, minimal docs |

| IndusInd Bank | 10.49% | ₹50,000 – ₹30 lakhs | 12 – 60 months | 1-3 days | Quick disbursal |

| Yes Bank | 11.25% | ₹50,000 – ₹20 lakhs | 12 – 60 months | 1-3 days | Best for salaried professionals |

Key Strategies to Get the Best Personal Loan Rates

1. Boost Your Credit Score Before Applying

- Pay all EMIs and credit card bills on time.

- Avoid applying for multiple loans/cards at once.

- Keep credit utilization ratio below 30%.

2. Shop Around and Compare Offers

Use online aggregators and direct bank websites to get customized quotes.

3. Choose a Shorter Tenure If Possible

Though EMIs increase, total interest paid decreases dramatically.

4. Negotiate With Your Bank

Especially if you have a good relationship or pre-approved offers.

5. Maintain a Stable Job and Income Proof

Lenders value stability highly.

6. Avoid Multiple Applications

Multiple loan applications can lower your credit score and raise your perceived risk.

Understanding Hidden Costs and Fees

- Processing Fees: Typically 1%-2% of loan amount.

- Prepayment Charges: Some lenders charge fees for early repayment (usually 2%-5% of outstanding principal).

- Late Payment Fees: Penalties ranging from ₹200 to ₹1,000 per delayed EMI.

- GST on Processing Fees: Applicable as per government norms.

Always factor these costs in besides the interest rate to calculate the real cost.

How Personal Loan EMI is Calculated?

EMI = [P × r × (1 + r)^n] / [(1 + r)^n – 1]

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual rate/12/100)

- n = Total number of EMIs (months)

Example

Loan Amount = ₹5,00,000

Interest Rate = 10% p.a. = 0.00833 monthly

Tenure = 60 months

EMI = [500000 × 0.00833 × (1 + 0.00833)^60] / [(1 + 0.00833)^60 – 1] ≈ ₹10,624

Case Studies — Comparing Loan Costs

Case 1: Borrower A with Good Credit Score (780)

- Loan Amount: ₹5,00,000

- Interest Rate: 9.99% p.a.

- Tenure: 5 years

- EMI: ₹10,619

- Total Interest: ₹1,37,128

Case 2: Borrower B with Moderate Credit Score (700)

- Loan Amount: ₹5,00,000

- Interest Rate: 12.5% p.a.

- Tenure: 5 years

- EMI: ₹11,124

- Total Interest: ₹1,67,422

Difference in cost over 5 years: ₹30,294

This highlights how credit health impacts cost.

When to Avoid Personal Loans?

- If you have poor credit: You might get very high rates.

- If you can borrow cheaper elsewhere: Home equity or secured loans usually have lower rates.

- If your purpose is speculative: Avoid using personal loans for risky investments.

- If repayment capacity is uncertain: Don’t overborrow beyond your income limits.

Evolution of Personal Loan Interest Rates in India and Globally

Historical Context

Personal loan interest rates have witnessed considerable fluctuations over the past two decades:

- Early 2000s: Rates were high, often exceeding 18-20% due to limited competition and banking infrastructure.

- Post-2010: Financial reforms, technological adoption, and regulatory interventions led to more competitive rates, often around 12-15%.

- After 2020 Pandemic: RBI cut repo rates to historic lows, leading to a drop in lending rates including personal loans.

- 2025 Status: Rates have stabilized around 10-12% with fintech innovation further pushing rates down in select cases.

Impact of Macroeconomic Factors on Personal Loan Rates

Role of RBI’s Monetary Policy

- RBI’s repo rate changes influence the base lending rates of banks.

- Lower repo rates often translate into reduced personal loan interest rates.

- Inflation trends can prompt RBI to raise or lower rates to maintain economic stability.

Economic Growth and Employment

- High economic growth and employment improve borrower confidence and reduce default risk, encouraging lenders to offer lower rates.

- Economic downturns tighten lending conditions and raise rates due to increased risk.

Deep Dive Into Different Types of Personal Loans and Their Rates

Standard Personal Loan

- Unsecured, fixed interest.

- Used for general purposes.

- Rates: 9.99% to 15%.

Salary Advance Loan

- Short-term, linked to salary.

- Often lowest rates (9.5% – 11%).

- Quick disbursal, minimal docs.

Education Personal Loan

- For higher education expenses.

- Often have concession rates or moratorium periods.

- Rates: 10% to 13%.

Debt Consolidation Loan

- Used to combine multiple debts.

- May offer lower interest than credit card debts.

- Rates: 10% to 14%.

Medical Emergency Loan

- Fast disbursal, flexible tenure.

- Rates vary 10% – 16%.

How Fintech is Changing the Personal Loan Landscape

Quick Digital Approvals

- Online platforms use AI and machine learning to assess credit risk quickly.

- Many fintech lenders offer instant approvals with minimal documentation.

Competitive Interest Rates

- By reducing overheads, fintech lenders sometimes provide lower interest rates than traditional banks.

- Examples: PaySense, EarlySalary, CASHe.

Personalized Loan Offers

- Algorithms analyze spending, income, and credit history to tailor rates.

Impact of Open Banking and Credit Data

- Open banking policies enable lenders to access comprehensive financial data.

- This leads to better risk assessment and potentially lower rates for good borrowers.

Detailed Profiles of Top Personal Loan Lenders in India

IDFC FIRST Bank

- Starting rate: 9.99%

- Features: Instant disbursal, minimal documents.

- Best for: Salaried individuals with good credit.

HDFC Bank

- Starting rate: 10.50%

- Features: Flexible tenure, EMI holiday options.

- Best for: Long-term borrowers.

Bajaj Finserv

- Starting rate: 11%

- Features: Fully online, instant loan amount.

- Best for: Quick funds with digital processing.

State Bank of India (SBI)

- Starting rate: 10.30%

- Features: Government backing, preferential rates for govt. employees.

- Best for: Low-risk borrowers and government workers.

Axis Bank

- Starting rate: 10.40%

- Features: Pre-approved loans, competitive rates.

- Best for: Existing customers.

How to Calculate Total Cost of a Personal Loan (Including Fees)

Components of Cost

- Interest payments (largest chunk)

- Processing fees (1%-2%)

- Prepayment penalties (if any)

- Late payment charges

- Insurance premiums (optional)

Example Calculation:

Loan Amount: ₹5,00,000

Interest Rate: 10% p.a.

Processing Fee: 1.5% (₹7,500)

Tenure: 5 years

- EMI: ₹10,624

- Total EMI paid: ₹6,37,440

- Total Interest: ₹1,37,440

- Total cost including processing fee: ₹6,44,940

Tips to Negotiate Better Personal Loan Rates

- Showcase a strong credit history: Bring credit reports to the bank.

- Leverage existing banking relationship: Ask for loyalty discounts.

- Request fee waivers: Processing fees can sometimes be waived.

- Compare pre-approved offers: Use multiple offers to bargain.

- Opt for automatic EMIs: Some banks offer interest rate discounts on auto-debit.

Understanding the Risks Associated with Personal Loans

- Over-borrowing: Leads to unmanageable debt.

- Hidden Charges: Always read fine print.

- Fraud Risks: Beware of fraudulent lenders offering “too good to be true” rates.

- Impact on Credit Score: Missed payments hurt future borrowing.

- Debt Cycle Trap: Rolling over loans with high-interest can create a debt spiral.

Alternatives to Personal Loans for Lower Interest Rates

Home Equity Loans

- Secured against property.

- Interest rates 7% – 9%.

Gold Loans

- Secured against gold.

- Interest rates 9% – 12%.

Credit Card Balance Transfer

- Can offer 0% interest for limited periods.

Peer-to-Peer (P2P) Lending

- Rates depend on investor appetite but can be competitive.

How COVID-19 Pandemic Changed Personal Loan Interest Rates

- Initial surge in interest rates due to higher risk perception.

- RBI’s intervention brought rates down with moratoriums and special schemes.

- Increase in digital lending and contactless approvals.

- Rise in personal loan demand for medical and emergency expenses.

Personal Loan EMI Calculator Explained

- How to use online calculators.

- Inputs required: loan amount, interest rate, tenure.

- Impact of prepayment on tenure and interest.

- Examples showing savings from prepayment.

The Role of Credit Bureaus in Determining Loan Rate

- Major credit bureaus: CIBIL, Experian, Equifax.

- How credit reports affect interest rate offers.

- Tips to improve credit scores.

Regulatory Environment Affecting Personal Loan Rates

- RBI’s guidelines on interest rate transparency.

- Fair lending practices.

- Impact of new data protection laws on credit reporting.

Future Trends in Personal Loan Rates and Lending

- Increased use of AI for personalized rates.

- Blockchain for secure, transparent loan processes.

- Expansion of micro-loans and nano-loans.

- More flexible tenure and EMI options.

- Integration with digital wallets and BNPL (Buy Now Pay Later) schemes.

Also Read:- What Will a Payday Loan Really Cost You?

Conclusion

The best personal loan rates available today hover around 9.99% to 11%, especially with private banks like IDFC FIRST and Axis Bank offering competitive packages. Public sector banks like SBI and others remain attractive due to government backing and slightly conservative risk policies.

Your personal loan interest rate depends primarily on your creditworthiness, income stability, loan amount, and tenure. By improving your credit score, maintaining financial discipline, and comparing lender offers, you can secure loans at the best possible rates.

Always remember to factor in processing fees, prepayment penalties, and other charges before finalizing a loan. Responsible borrowing and timely repayment not only save money but also help maintain a good credit score for future financial needs.

FAQs

Q1: Can I get a personal loan with zero interest rate?

A: Rarely. Some promotional offers might offer 0% interest but usually require repayment in a very short period or have hidden fees.

Q2: How does my salary affect personal loan rates?

A: Higher and stable salary assures lenders and can help you get lower interest rates.

Q3: Is documentation complex for personal loans?

A: Traditional banks require detailed documents; fintech lenders offer minimal documentation and quick disbursal.

Q4: Can I get a personal loan without a credit score?

A: New-to-credit borrowers can sometimes get loans with proof of income and employment, but rates might be higher.

Q5: What happens if I miss an EMI?

A: You’ll incur late payment fees and your credit score may drop.

Q6: Are personal loans taxable?

A: The principal and interest are not taxable. However, if used for business, interest may be tax-deductible.

Q7: Can I increase my personal loan amount after approval?

A: Generally, no. You would need to apply for a fresh loan or top-up loan.